Category: Investing basics

- 8.03.2020

- Categories: Analytics, Investing basics, Personal finance

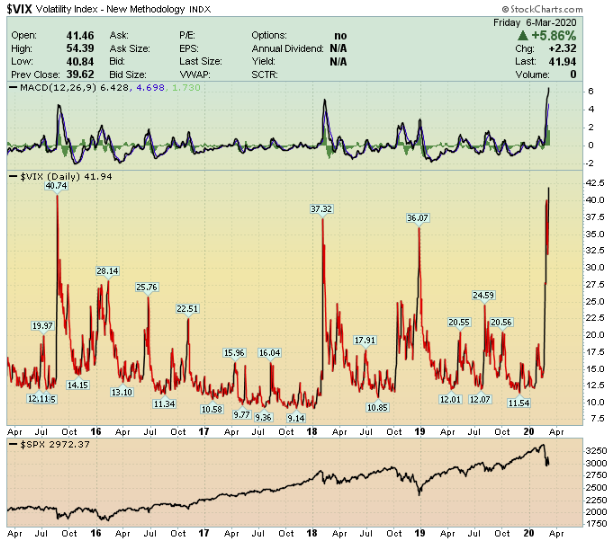

- Tags: CPCE, NYMO, NYSI, P/C Ratio, SKEW, SPX, vix, volatility

- 23.02.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, Russell 2000, Seasonal Strategy, SPX

- 15.02.2020

- Categories: AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, s&p500, SPX, SPY, Stocks

- 6.02.2020

- Categories: Analytics, Investing basics, Personal finance

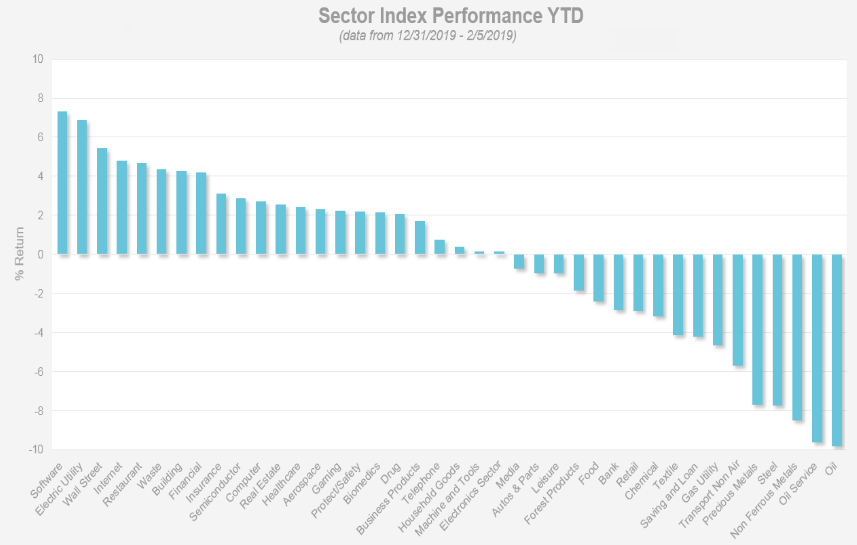

- Tags: Momentum, Relative Strength, Sectors, SPX

- 8.10.2019

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

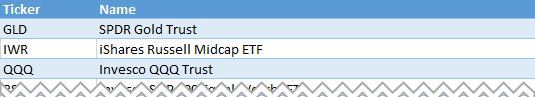

- Tags: ETFs, IYW, QQQ

I write here to set out my thoughts on the use of life insurance as an investment vehicle, in the Russian context. Clients of all the jurisdictions invariably seek to optimise their tax position in which they operate. This includes holding assets that are so-called passive investments. There is a long history of legal systems …

- 11.09.2019

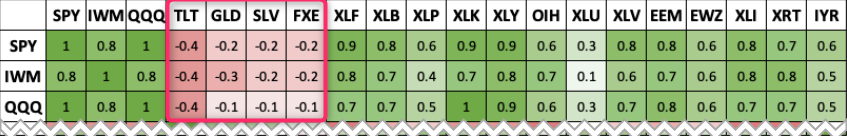

Below we show a correlation matrix of some of the more popular US ETFs. As a reminder, the closer the correlation is to +1 the stronger the positive relationship. And the closer the number to —1 the stronger the negative relationship. How can we use this knowledge? Two ways: Diversification. One of the tenants of …

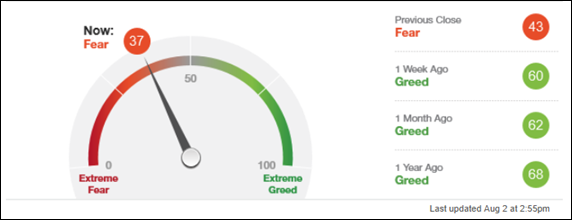

- 3.08.2019

- Categories: Analytics, AVC Pro Subscription, Investing basics

- Tags: NYA50R, NYHL, NYMO, P/C Ratio, SPX

- 26.07.2019

- Categories: Analytics, Investing basics, News, Personal finance

- 20.07.2019

- Categories: Investing basics, Investment ideas, Personal finance

- Tags: International, Investing, NASDAQ, Stocks

Recently Bloomberg commented on a newly released study by Hendrik Bessembinder regarding how many global stocks that actually perform well. Variations of this study have been done by a number of different academics and practitioners – all with fairly similar conclusions – many stocks are duds. Two years ago, an Arizona State University professor made waves …