Category: Investing basics

- 23.11.2020

- Categories: Investing basics, Investment ideas

- Tags: AT&T, bitcoin, dividend, Exxon, GLD, IBM, Tech

- 6.11.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Personal finance

- Tags: DJIA, NASDAQ, NDX, QQQ, SPX

The MACD indicators applied to DJIA, S&P 500 and NASDAQ are all positive as of today’s close. These leads to several buy signals across various equity indexes, according to the seasonal investment strategy.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 2.10.2020

- Categories: AVC Pro Subscription, Investing basics, Investment ideas, Personal finance

- Tags: AGG, BND, DJIA, MASDAQ, Russell 1000, Russell 2000, SPX

After five straight monthly gains, the US stock market finally came under pressure in September. The NASDAQ hit the 'correction level' of a 10% slide. Markets have rebounded, but October is usually weak. Patience is needed for entry into the seasonally positive part of the year.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 21.09.2020

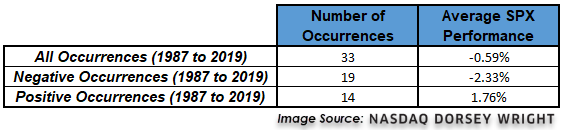

- Categories: Analytics, Investing basics, Personal finance

- Tags: Seasonal Strategy, Seasonality, SPX

- 18.09.2020

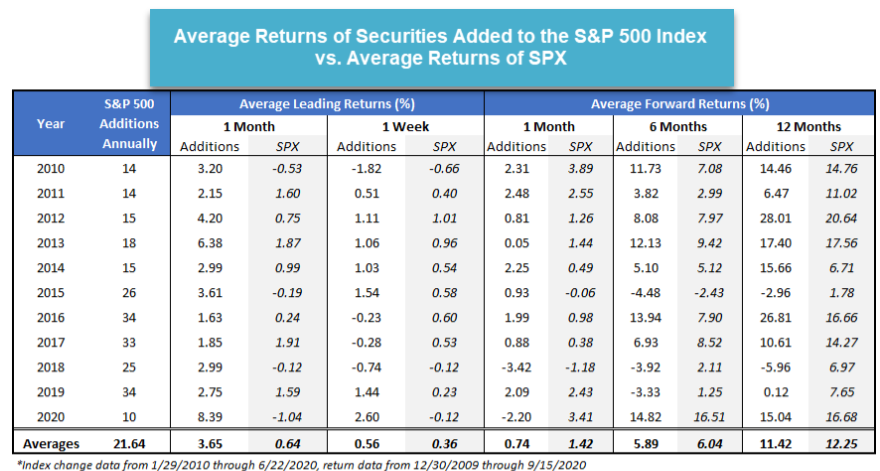

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas, News

- Tags: CTLT, ETSY, SPX, TER

We examine whether there is a performance advantage for stocks being added to the S&P 500.

To access this post, you must purchase Subscription Plan – AVC Pro.

- 14.09.2020

- Categories: Analytics, Investing basics, Personal finance

- Tags: GRPN, Market Timing, RCL, Risk, SPX

The key to a successful investment strategies involve three main elements: what to buy, when to buy, and how much to buy. We will look at each of these elements individually as we focus on creating successful investment strategies.

- 27.08.2020

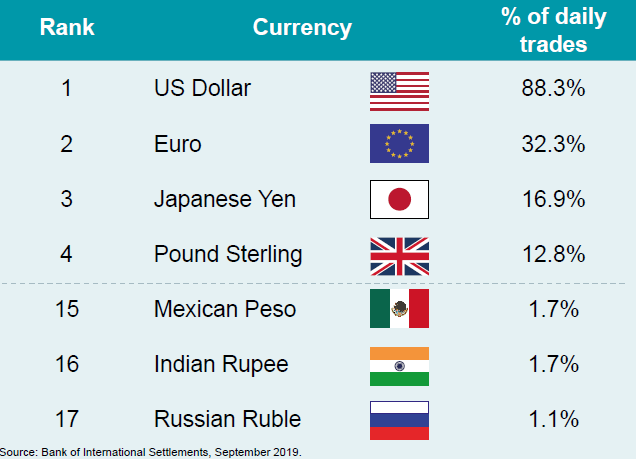

- Categories: Investing basics, Personal finance

- Tags: diversification, dollar cost averaging, ruble, russia

Wherever you are in the world, the strength of your country's local currency can be adversely affected by many different factors. Uncertainty encourages many investors to look outside of their local savings and investment markets, in a bid to access products that provide the opportunity to invest in ‘hard currencies’, specifically USD, GBP and EUR. Certain products enable investors to secure their savings in a long term financial secure manner.

- 25.07.2020

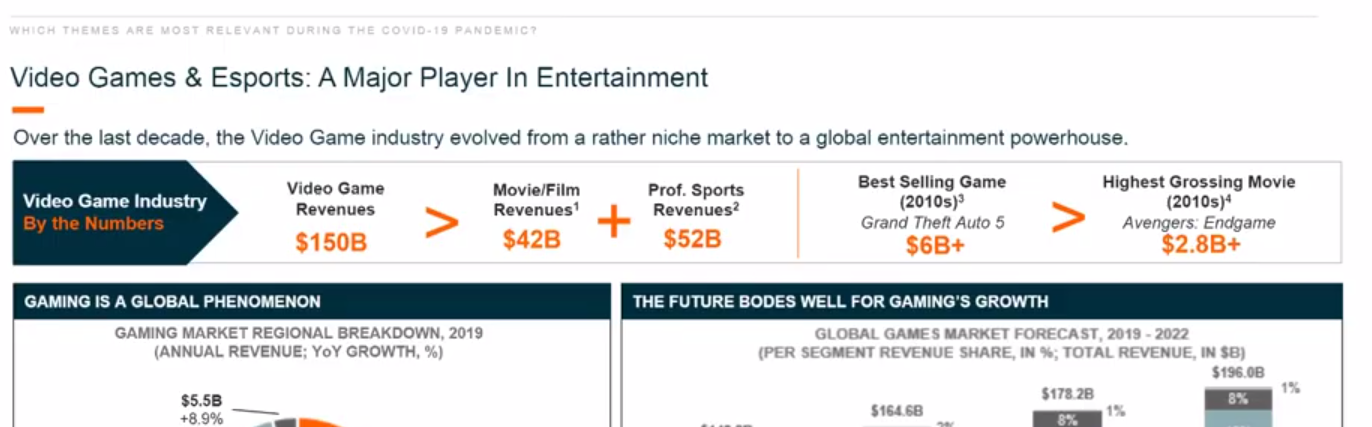

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: ETFs, Gaming, Gazprom, GLD, Natural Gas, PSQ, QQQ, SLV, TAM, TTWO, UNG

- 19.07.2020

- Categories: Analytics, Investing basics, Investment ideas, Personal finance

- Tags: dividend, FAANG, Health Care, Seasonality, SPX, Tech

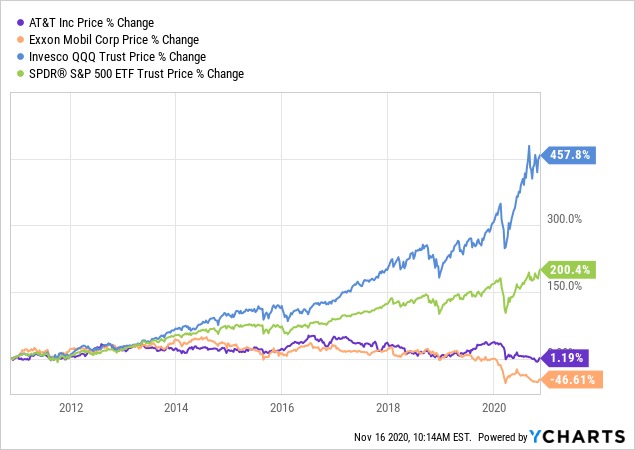

Are markets overbought? The narrow bull market in FAANG and some other technology stocks has led to concern among analysts that stocks are out of sync with the economy. We explore how interest rate assumptions affect analyst pricing in discounted cash flow models and lead to inflated asset prices. A discussion of the opposite case …

- 17.07.2020

- Categories: Analytics, AVC Pro Subscription, Investing basics, Investment ideas

- Tags: Coronavirus, DJIA, NASDAQ, NFLX, Russell 1000, Russell 2000, S&P 500

NASDAQ’s mid-year rally (described here in late June) came to an end on July 14. From mid-July, the second quarter is usually plagued with poor performance. Enthusiam and large amounts of cash on the sidelines could keep stock prices aflot. Hower, defensive positioning seems a more reasonable bet.

To access this post, you must purchase Subscription Plan – AVC Pro.