Wherever you are in the world, the strength of your country’s local currency can be adversely affected by many different factors, including:

- Political unrest

- Economic policy

- Government stability

More often, the strength of a local currency is a reflection of a country’s economic, social and political stability, adding an additional layer of uncertainty to long-term investing for many investors. Such uncertainty encourages many investors to look outside of their local savings and investment markets, in a bid to access products that provide the opportunity to invest in ‘hard currencies’, specifically USD, GBP and EUR. These currencies tend to:

- remain more stable through uncertain times

- have the ability to recover sooner

- be easily convertible and widely accepted

- maintain the confidence of international investors and businesses.

The popularity of hard currencies

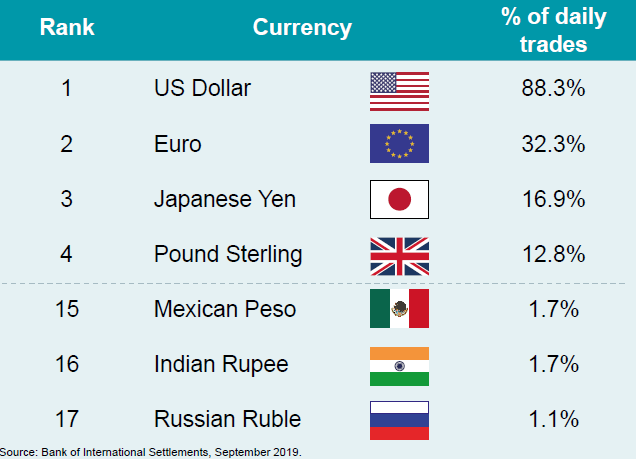

Investor confidence in hard currencies is clearly demonstrated when looking at the popularity of their use in global trading.

The table displays the percentage of trades of a particular currency, regardless of whether it is bought or sold (e.g. the USD is bought/sold in 88% of all trades). By comparison, the Mexican Peso and Russian Ruble are bought or sold just 1.7% and 1.1% respectively.

In Russia, tax reforms and central currency policy continue to suuport ruble weakness. These policies policies harm long term savings sentiment in Russia and make hard currency savings mandatory.

We can mitigate currency risks through portfolio diversification by firstly, setting a long term life insurance contract in either USD, GBP or EUR. Investors can pay their contributions using their local currency which will be converted on receipt. This is ideal for clients wishing to place their savings in an alternative currency, especially if their local saving options are limited.

Secondly, people saving long term for their retirement can choose a regular, automated, monthly savings plan which allows their monthly contributions to purchase units at both highs and lows in the market, smoothing out volatility in unit prices and currency rates. This effect is well known as dollar cost averaging.

Investors can allocate those monies to a multi-currency fund range for investing in various regions and countries around the world. This provides real diversification among various asset classes that are reactive to currency fluctations.

Finally, specific funds trade currency trends and offer further opportunities to actually profit from currency volatility. For instance, through various life insurance companies investors can access MAN AHL funds which offer regular savings investors to well establised trend following systems in currency futures.