The Guinness range of funds has long been a favourite of advisors and clients alike due to its success of returns, in particular the Guinness Global Innovators fund has returned almost 15% annualised since 2010. Thus the launch of the new addition to the stable, the Guinness Sustainable Equity fund was eagerly awaited at the end of 2020.

We talked with fund manager Sagar Thanki and looked under the bonnet at this interesting fund.

Of course, sustainability and ESG (Environmental, Social, Governance) are watchwords which get everyone excited in the asset management sphere so what sets this fund aside from the rest is the screening criteria applied and the weighted allocation to those assets.

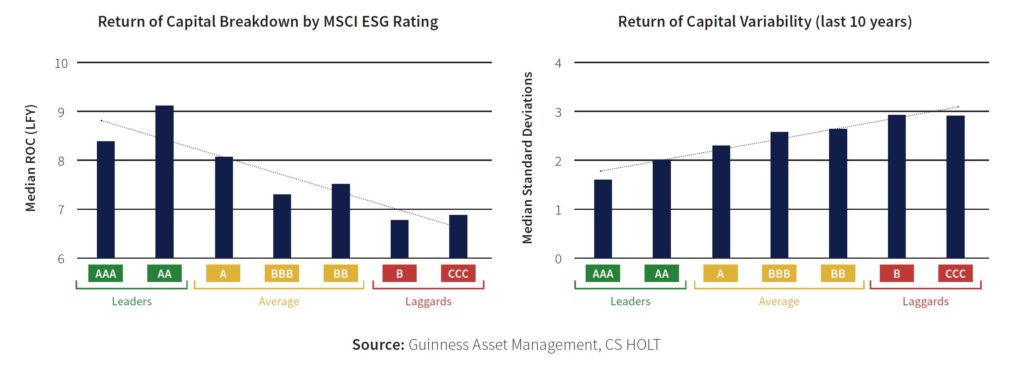

According to Thanki, the fund is trying to profit from opportunities arising in the transition to a more sustainable economy – and planet! He also said that there is consistent evidence to support the fact that sustainable and environmental sensitive companies do actually perform better and return better value to stakeholders, as the reputation in the marketplace leads to increased and sustained usage by consumers, who are driving the move to a more sustainable economy.

Setting apart the banality of the pledge to invest only in ‘quality’ companies, who are trying to minimise pollution and other environmental damages, lets look at how the ‘screener’ works.

The keyword here is ‘quality’ – and Thanki

defined that as companies having a “history of persistently high and improving

return on capital” and he seeks “companies with strong balance sheets and

avoids those which have taken on significant leverage in order to fuel their

growth.”

To quantify this, the fund managers look at a Return on Capital (RoC) of more

than 10% annually over the last 10 years.

The managers also have a sharp eye on mid cap companies, looking at companies in this sector who have offered an RoC in excess of 10% over the last five years.

Indeed, there is a bias towards Mid-Cap companies within the portfolio, in part due to the lack of value and opportunities at the large-cap end. This is emphasised by the focus on capital growth, which is maybe more difficult for large caps, and as the fund is benchmark unconstrained, Thanki and his team are able to buy around 30 stocks in an equally weighted allocation and hold those for the long term reducing turnover and associated fees

Thirty names may seem like a very low number, but according to Thanki, when applying the proprietary screening that Guinness developed, only a relatively small universe are left standing in any case.

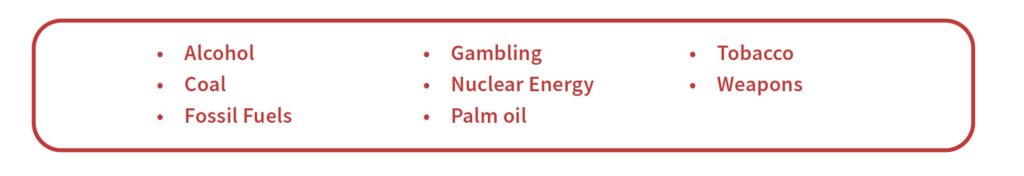

If the criteria of 10% over five or ten years is applied, there is only around 5% of listed companies in the world which fit. Further, reduce that number by removing highly leveraged corporates, i.e. with debt/EBITDA greater than 3. Finally, remove all those who do not fit the ESG model, which is defined by the Norwegian Council of Ethics exclusion list, then the pool is more of a puddle.

Well, that’s what is not in the portfolio, but what areas of focus are the managers concentrating on to include WITHIN the portfolio? The answer falls under broadly 3 umbrellas;

- Health & Wellbeing, such as Pharma, Med Tech and Nutrition

- Productivity and Connectivity, such as Semiconductors and Internet of Things

- Resource Efficiency, such as Clean energy and water management

If we return for a moment to the novelty of equal weighting in the portfolio, we quizzed Thanki on the rationale behind this and he responded with a handful of benefits.

Most important is that the team have a high conviction over each stock included and the weighting is more than the average weighting in the MSCI World Index, so if the company fails to perform it is discarded, not kept to drag the portfolio.

Further if the company underperforms but is still held in the conviction box, the managers are able to add positions over time, as opposed to adding new companies and expanding the count of stocks held. This allows efficient rebalancing of the portfolio with long term benefits.

Of course, if the stock does need to be removed it is only taken out to be replaced by another. This in turn increases the conviction level as capping the portfolio at 30 names and keeping allocation balanced means that the allocation to the smallest sized company in the portfolio is approximately the same as the biggest name, demonstrating increased conviction on the smaller name.

It is early days but the fund is well positioned for the future, however that may look and we wish the managers continued and renewed success.