The Financial Conduct Authority definition of ‘financial vulnerability’ encompasses aspects of both financial and mental health. A vulnerable client is ‘someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care’. According to the Financial Lives Survey conducted in 2017, 50% of all adults in the UK are included in this category – a huge 27.7million people.

It is increasingly common in the current environment that people really struggle with the complexity of savings and personal financial products. It may be that due to the pandemic, the person has lost their job and has a result developed mental issues. The opposite can also occur that due to loneliness and lack of family contact people have developed mental issues which has resulted in them losing their job – a tragic vicious circle of events.

A 2016 study by The Money and Mental Health Policy Institute concluded that 48% of adults with mental health problems were unable to weigh up the advantages and disadvantages of a loan product, for instance. The COVID pandemic has, therefore, put more people at risk of becoming financially vulnerable.

Temporary or Permanent

Situations like the COVID pandemic can create a temporarily stressful condition for everyone. This may come from the death of loved one, loss of a job, or even just the stress of a new lifestyle of working from home. This has deep effects, both psychologically and financially. In the case of a death in the family, it is particularly critical if there is no estate planning in place. Indeed, this can have a terrible effect on the day to day living quality of the surviving spouse or children. It is not uncommon for one of the couple to have control over all the bank accounts, loans, mortgages and bill payments. Upon death these all have to be identified and promptly taken over otherwise debts can stack up, housing can be repossessed, and all sorts of awful situations can occur.

As people live longer and suffer long term mental illness such as dementia, Alzheimer’s, and just simple cognitive decline, a permanent situation develops. People with these conditions put themselves and their loved ones in the realm of financial vulnerability as the sophistication of insurance, banking, housing, and medical care become too much to manage.

Sources

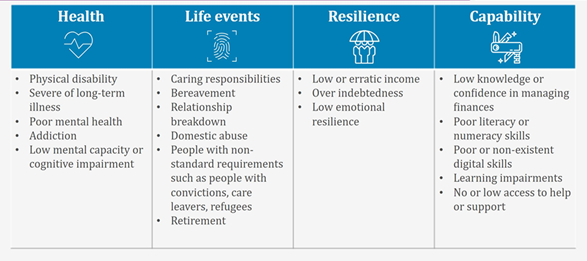

There are four identifiable sources of identifiable financial vulnerability: Health Issues, Life Events, Financial Stress (Resilience), and Inherent Capability. However, most situations involve multiple sources with compounding effects.

The most common situation we see is the shift from a full time employment to retirement. This has been exacerbated by the COVID pandemic, as many highly paid senior managers decided to enter full time retirement after the ‘work from home’ lifestyle became the new norm. We also saw those that developed COVID become critically ill and at least temporarily incapacitated. Further, some people developed mental issues such as dementia or show signs of losing their mental faculties to the point where they cannot make important financial decisions regarding their home, their family and their investments.

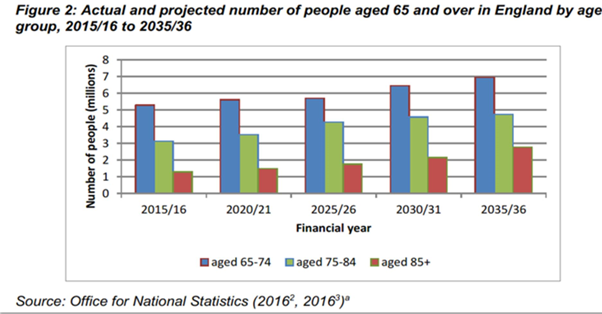

An ageing population is only expected to grow in terms of percent of population.

Adding all three columns together in the chart above, the numbers are staggering. In the UK, the forecast is for an increase from around 9 million people in England over the age of 65 in 2015, to almost 15 million over the age of 65 in 2036. One can also see that the biggest increase is in the 85+ category and this is where most issues regarding mental faculties arise.

More and more elderly will require different financial planning requirements, including long term care (LTC) fee planning, succession planning, and income strategies to provide for extended retirement. Meanwhile, physical disabilities, mental capacity issues and worries of running out of money hinder making good decision.

Some of the statistics around the problem are daunting. For instance, one in ten in the UK currently pay more than 100,000 GBP yearly in care home fees, but only 1 in 4 in the UK take steps for LTC fee planning.

The Power of Attorney

A common way in the UK to mitigate many of these issues is to put a Power of Attorney (PoA) in place. This allows a family member, usually, to legally make financial decisions on behalf of the person. This differs from a Trust in that the assets stay 100% in the name of the owner.

The use of PoAs has increased by 180% in the last 5 years in the UK and that the use of this instruments occurs in 48% more cases involving women than men, possibly because women outlive men and also women are more likely to be classed as ‘vulnerable’.

One can imagine this is fraught with issues from just establishing a PoA to an abuse of position and fraud. There is not the space to get in depth on these issues in this article, but suffice to say in the UK there is considerable protection for the person concerned through financial and legal regulations, usually involving the Office of Public Guardian.

However financial advisory firms do need and are expected to play a critical role in helping smooth the process of PoAs, although this is not always successful. Indeed one can also complain to the Financial Ombudsman service in the UK about poor service from the IFA, including refusal to accept a PoA, not understanding the PoA, not updating systems and records timely and incorrectly registering the PoA.

Amongst FCA guidance is four guiding factors which we believe should be borne in mind by advisors

- Understand the potential vulnerability of the clients

- Improve the skills and capability of staff

- Practical Action – service design, customer service, communication

- Monitoring and evaluation

AVC Advisory pledge to improve all the above areas to fight financial vulnerability. In practical terms, how do our advisors assist vulnerable clients?

- Being heard and treated with empathy

- Help to understand the information, repeatedly if required

- To communicate written and orally in a simple way

- Clear on costs

- Information in advance of meetings

- Encourage client to ask questions to confirm understandings

- Provide a singular regular point of contact

- Offer to meet at clients home

- Offer an introduction to the advice available for free

- Adapt to support individuals with symptoms