The year ended strongly for the world’s equity markets and commodities. The strength in non-US markets was exceptional. Commodities finally came back to life after months of listlessness.

The S&P 500 strengthened in the first part of the month, and then traded sideways for the last two weeks. The last three months have been very bullish for US markets.

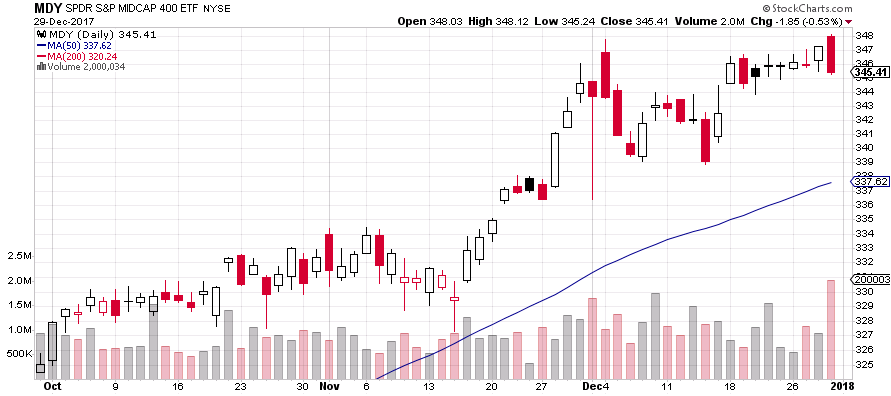

Medium and Smaller US companies did not have such a strong performance in December. They traded with weakness in the first half of the month with more weakness on the last trading day.

The sectors that traded well in December were different that performed well throughout the year. Energy and Industrials lead in December.

During all of the 2017, technology was the star, while energy shares lagged. A change in leadership often accompanies late stage bull markets. Inflation could be around the corner if energy shares continue to lead the markets.

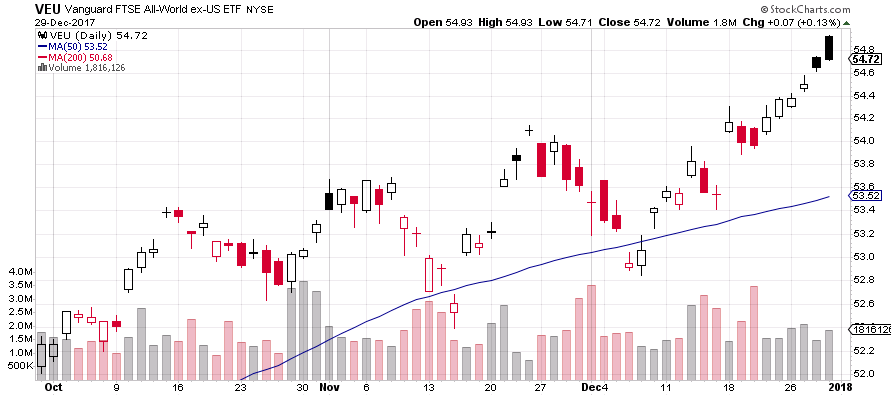

Real strength developed in non-US stocks as December rolled on. Developed markets ended 2017 on a very positive note and are now far extended off of support levels.

Emerging markets showed great strength also. Although they traded the first week of December with a break below the 50—day moving average, emerging market stocks finished strong. We feel that Indian and China look like great investments for the first quarter of 2018.

Real Estate stocks suffered a massive mid-month sell off after the Federal Reserve raised interest rates. However, RWO remained above its 50-day moving average, therefore retaining its bullish trend for the last three months.

The strength in natural resource stock was tremendous. Energy stocks and miners led the market in December. They are now far extended above support.

Commodity prices rebounded strongly in the second half of December. Inflation is likely to show up in the future if this trend continues.

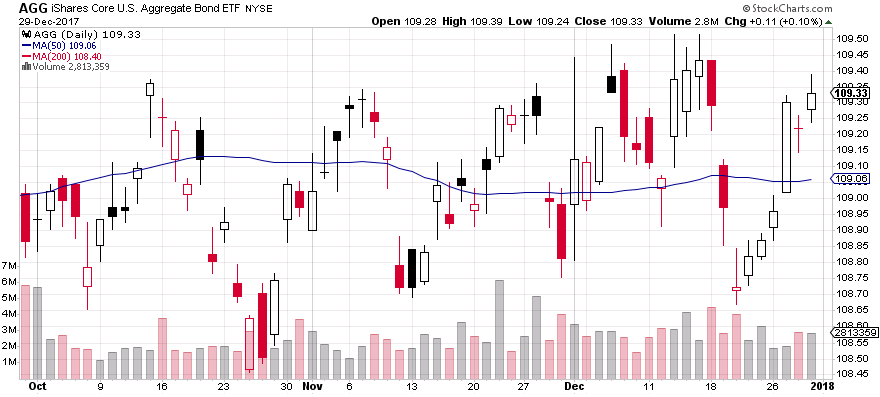

US bonds have traded range bond for the entire fourth quarter. AGG is just trading sideways around its 50-day moving average as neither high interest rates nor fears of inflation can push it lower.

Inflation linked US Treasuries (TIP) broke above 114 and into higher ground. This is another sign that market participants see inflation coming soon.

Non-US bonds are a bit more bullish than US bonds, as interest rates are not yet rising in many places. Again, mid-month after the US raised interest rates, bonds sold off.

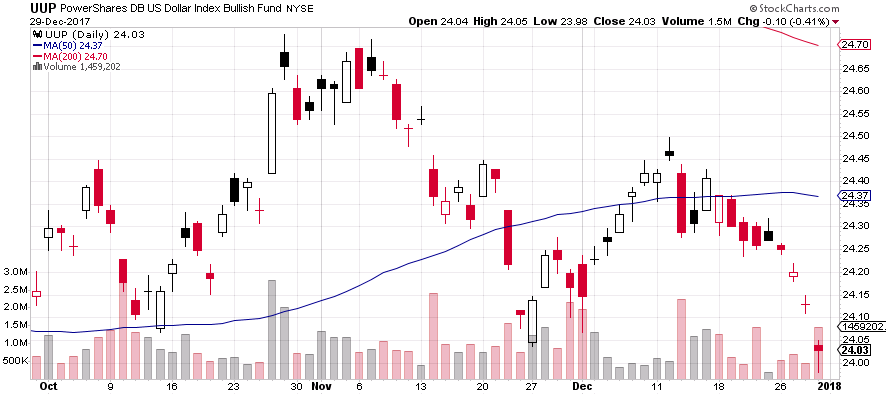

Even though the US raised interest rates, the USD sold off hard. This spurred on the rise in commodity prices and outperformance by energy stocks. UUP is rolling over into a bearish trending 50-day moving average which could be significant in 2018.