Who does not want to invest in the finest produce the world can offer?

The latest fashion? The fastest cars? The best gadgets? All of which are fantastic products to own but it turns out it is not a bad investment choice either.

The Dominion Global Luxury Fund returned a tidy 16% in USD over the past year and almost 50% increase in NAV over the last 2 years, and so it seemed an appropriate time to sit down with the Head of Equity Strategy at Dominion Global Strategies, Christian Cole, to dissect the current allocation and the themes driving the fund forward.

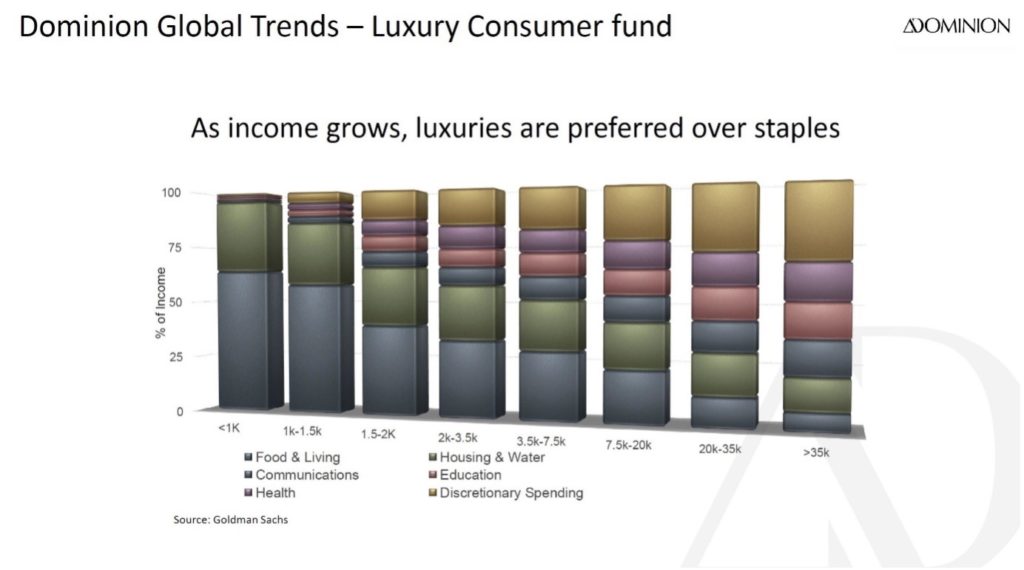

With historic low interest rates and quantitative easing being employed by every major central bank globally, it has never been easier as a consumer to buy ‘luxury’. In socio-economic terms, people generally have more to spend on non-essential items the more they have as income.

Worth an estimated $1.2 trillion annually, the ‘luxury’ market encapsulates all what we conventionally know as such products and services. However, one may be surprised to realise that some of the assets held in the portfolio stretch that definition to its limits.

One such interesting holding is IDEXX Laboratories. This company is leader in pet medical diagnostics. Christian Cole reminds us that the number of pets globally is far surpassing the growth in human population, and as such, there are 850million pets and all of them at some point in their lives will require the attention of a vet and accompanying medical problems. The fund holds an almost 5% allocation to IDEXX.

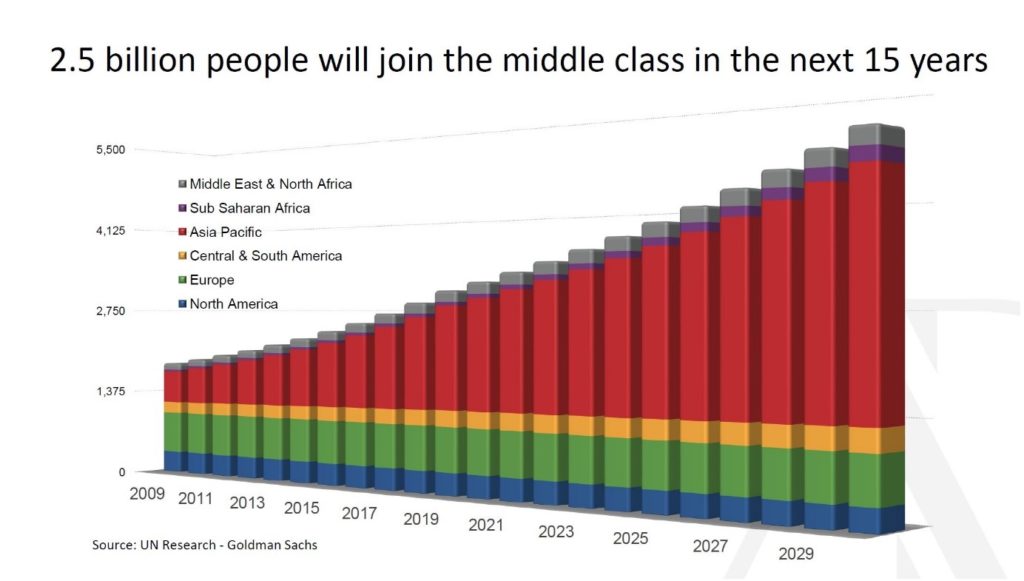

The numbers of people termed Middle Class will rise significantly in the world over the next decade, according to the United Nations.

“The number of affluent people (which is calculated by at least $250k investable wealth) in the world will increase from 52 million this year to 94 million by 2030. In Europe and the US their numbers will almost double while in China they will triple,” continues Cole.

Of course, a very conventional holding in the fund, in fact the actual stereotype of what typifies luxury is the Italian car manufacturer Ferrari. This producer sells a product which is not less than $250,000 to buy new but has a waiting list for its cars of more than 2 years. The secret is keeping demand high but supply minimal – only 9000 cars are produced annually, so there is plenty room to increase production if so desired. However, why would Ferrari increase production? Each car provides €50,000 free cash when it rolls off the production line at Maranello.

The success of the fund is significantly tied to the rise of the rich Asian consumer, which has previously been a mainstay of the growth in the sector since the rise of Japan in the ‘80’s. However now the wealth is more evenly distributed around the continent although China, due to its sheer size, is a vital part. Cole tells us that 79% of Chinese luxury consumers are aged under 40, much younger than their European or US counterparts.

One area the fund has recently started to allocate is Private Education, which has a focus on China. Although the global market is worth more than $300 billion, it is expected that Asia will take the lion share of growth going forward.

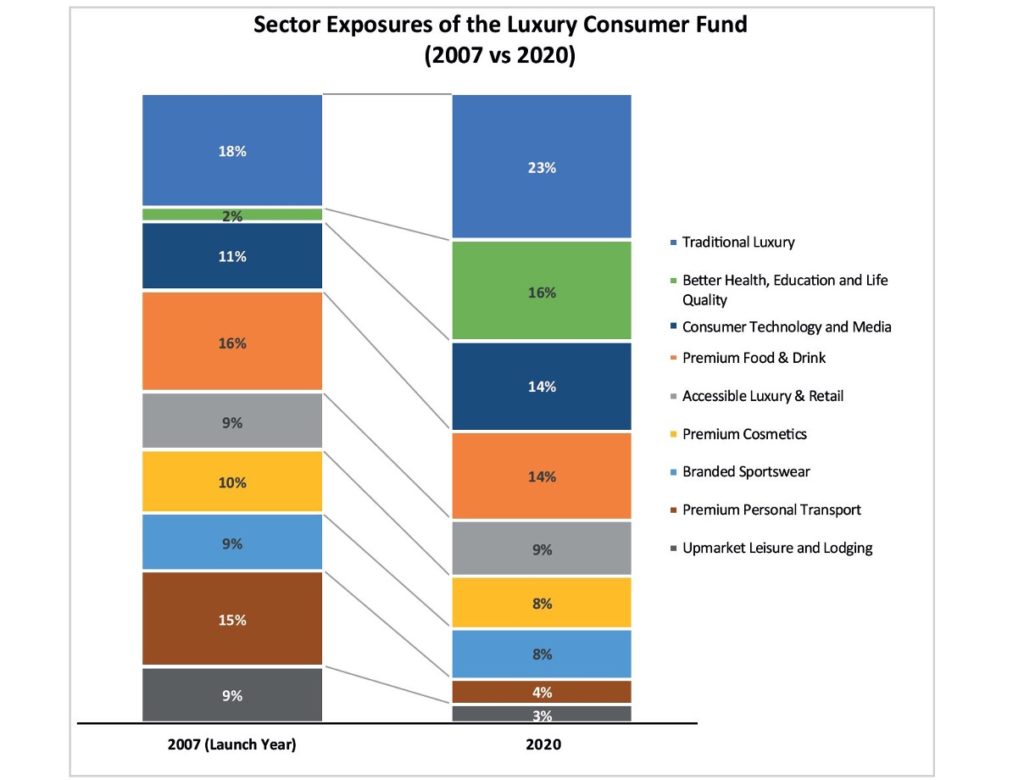

Discussing Private Education brings us nicely to an interesting aspect of the fund which we discussed with Investment Manager Cole, and that is the way the fund has changed its allocation since its inception in the late 2000’s.

A quick glance at the chart below shows 3 main themes. The rise of “Wellness” and the relative fall of Premier Personal Transport and Upmarket Leisure and Lodgings.

The Wellness sector, which focuses on the improvement of Health, Education and Life quality, has blossomed from the lowest exposure in the fund 15 years ago to second highest allocation this year.

As discussed earlier, we see the themes of Private Education and Pet Care, add in the growing ESG trend and move in general to ‘greener’ themes.

One of the reasons for a relatively high allocation to the personal transport sector in 2007 was the coming boom in demand for automobiles in China. That has largely played out, with an asset like BMW trebling in value in the intervening years, and so the allocation has fallen across the board. New research shows, according to Cole, that younger generations are not so inclined to have private car ownership and a perception that cars are not good for the environment is dampening that sector, Tesla notwithstanding.

One of the reasons for the low allocation to the Hospitality sector is simply a reflection of the times we are in, taken as a snapshot. Many hotels are closed or at limited occupancy and airlines, restaurants and other HORECA struggle through the pandemic. Having said that, Cole concludes that the long-term growth potential in this sector is strong, especially post-pandemic, as it will relight with pent up demand and cash in people’s pockets. This is in addition to the trends for more ‘experience’ type travel which typifies what the ‘luxury’ sector is likely to be in the future – with, for example, the advent of space travel for the (very affluent) masses.