We all know that there is no such thing as the perfect investment, but I have one that comes pretty close. Working with the American Association of Individual Investors for many years, I have done research on dividend paying stocks.

Investing in stocks that pay dividends offers a tantalizing triple play of 1) greater safety, 2) growth and 3) a steady stream of cash. These stocks also have very good liquidity because they attract large institutional money from pension funds, insurance companies and professional asset managers.

Yet many investors are missing out on this investment because of some widespread misconceptions and dangerous myths.

So let me below try dispel some of these myths and discuss how you can profit from the almost perfect investment — Dividend-Paying Stocks.

Myth #1: Dividend stocks are only for conservative investors who want safety and are willing to sacrifice overall return to get it.

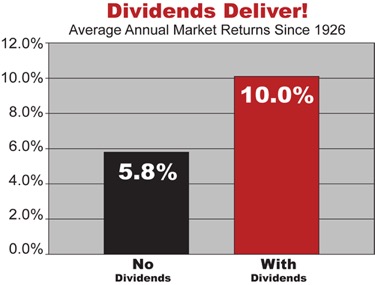

The following chart should change the way you think about investing in dividend-paying stocks forever …

As the chart above shows, when you take dividends out of the performance equation, historical return for US stocks falls from 10.0% annually to only 5.8%. As you can see, dividends are responsible for more than 40% of the market’s annualized long-term total return. Incredible!

So, if you aren’t investing in dividend-paying stocks, you are leaving lots of money on the table.

Myth #2: Dividend-paying stocks are the slow, boring way to invest.

There was a time when being a “dividend investor” was practically synonymous with being a shareholder is US public utilities- telephone, gas, and electric companies. But that is not the case anymore.

Companies like Intel, Microsoft, Texas Instruments, Target, even Nike all pay dividends.

Even tech superstar Apple has started paying dividends, paying more than $10 billion in its first year alone!

No industry or sector is off limits. You can build a very diversified portfolio of dividend paying stocks now with everything from consumer staples, pharmaceutical and financials to manufacturing and technology — and, yes, even a few high-yielding dividend-paying utility stocks would be useful.

Myth #3: The bigger the yield the better.

NEVER look for stocks with just the highest yield. In fact, an unusually high yield can actually be an important red flag because it signals a troubled company with undue risk and the possibility of a fall in share price.

Chasing yield is a recipe for disaster as many high yield stocks are REITs. These companies have to pay out large amounts – usually 90% – of their revenue in dividends. If revenues fall, so do dividend payments.

Rather than chasing yield, you need to review the 2,500 dividend-paying companies using a comprehensive system that quickly weeds out risky stocks and identifies the select dividend stocks worthy of your investment.

Myth #4: Paying dividends stymies a company’s future growth.

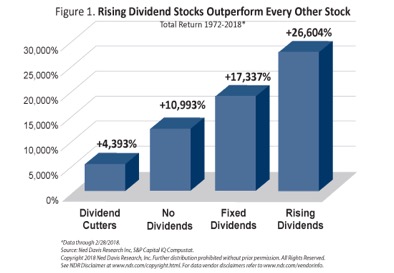

This is just flat out wrong. The opposite is actually true! Over the past four decades, stocks with rising dividends outperformed every other type of stock.

A 45-year study from Ned Davis Research and Oppenheimer Funds tells a clear story:

US dividend paying stocks with rising dividends greatly outpaced the stocks that cut their dividends or simply did not offer a dividend in the first place. They even beat those stocks that maintained flat dividends during that period!

Let’s look at what that means in real numbers:

- $100,000 invested 45 years ago in stocks with no dividends would be worth $11,093,000 today.

- $100,000 invested in stocks with fixed dividends would be worth $17,437,000. Not too bad.

BUT that same $100,000 invested in Rising Dividend Stocks would be worth an amazing $26,704,000! Note, investing in Rising Dividend Stocks over fixed dividend stocks would have boosted your profits by an average of 53% over the 45-year study.

Are you really willing to leave an extra $9.2 MILLION or more on the table?

An Almost Perfect Investment

Once you get past the myths, it’s easy to see that dividend investing is an almost perfect strategy that can give you superior total return, a steady income stream for life and protection in market downturns.

For income investors, dividend-paying stocks are favored because they can provide the stability, safety and income you want. But unlike the fixed interest payments of bonds, dividend-paying stocks can also give you growth from both a RISING DIVIDEND YIELD and from a RISING STOCK PRICE.

PLUS, dividend investing helps to minimize your risk, providing a cash cushion during volatile markets. Stock prices may rise and fall, but dividends can reward you year after year.

But how do you find the best dividend-paying stocks to buy among the more than 2,500 available?

Well, you are probably going to need some professional help. Remember though, we want to find a fund that focuses on holding stocks that increase their dividends year after year. We can assist in finding ETFs and specialist funds to access dividend stocks through a diversified portfolio, even at small investment amounts.