The Gulf Cooperation Council (GCC) is a political and economic union of states on the Arabian Peninsula bordering the Persian Gulf. Its status as an economic union is currently evolving with the possibility of the GCC becoming a tighter confederation and common market. Regardless of the political status of the bloc, the six independent nations of the GCC (Saudi Arabia, Qatar, the United Arab Emirates, Oman, Kuwaitand Bahrain) are strong emerging economies rich in natural resources.

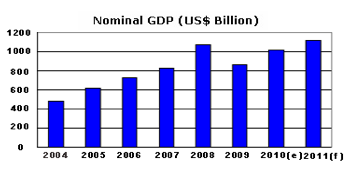

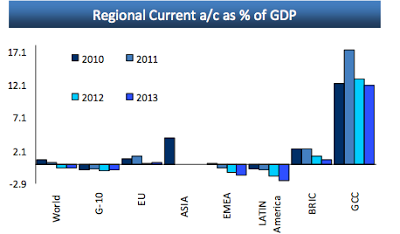

In the last twenty years, the nations that make up the GCC have worked to open their economies to foreign investment and ensure the political security of foreign capital. Altogether, the GCC has a GDP larger than that of Russia. Its annual growth has exceeded U.S. GDP growth for nearly five years. The group is expected to growth 4% in 2012, nearly a percentage point higher than the world average according to theIMF. This puts the GCC alongside theBRIC nations in terms of growth. Unlike the BRICs however, the GCC economies enjoy a current account surplus of over 13% of GDP. This frees these governments to spend money on infrastructure and other development projects, which will allow them to diversify their economies in addition to continuing to support the mostefficient oil production in the world.

GCC GDP Growth

The economic strength of the GCC has been fueled by its vast oil and natural gas reserves. Underneath the GCC lie 35.7% of the world’s known crude oil reserves. Oil output alone accounts for approximately 40% of the regions GDP. This dependence upon oil has concerned some foreign investors, especially in light of the political events of the pastyear. Oil rich states tend to be relatively politically repressive, laying ample ground for the type of anti-regime sentiment that has been behind the so-called “Arab Spring.” Protests in Bahrain against the ruling monarchy are an unfortunate indication of the risks facing foreign investors interested in investing in the GCC

Potential investors and their financial advisors also must navigate systemic economic symptoms of a resource dependent economy. Dutch disease, a phenomenon involving price inflation and employment patterns endemic to diversification, remains a risk to investors as these economies continue to export fossil fuels to satisfy growing demand in emerging markets. While inflation forecasts are down, in part due to prudent monetary policy on the part of the GCC nations, it remains an economic and political concern for investors.

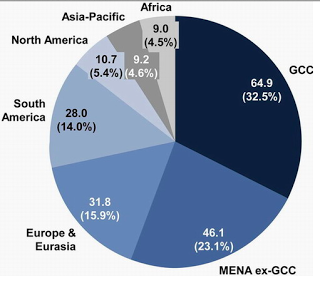

Given these risks, why invest now in a region that for the foreseeable future will be attached to oil? Investors should recognize that an investment in the GCC is primarily an investment in oil and the secondary sectors of the economy that support the region’s resource base. Current oil prices are strong and growing demand combined with geopolitical market shocks suggests they will end 2012 high and continue this trend. Long-termoil prices favor the GCC as other oil producing nations with less abundant reserves and less efficient production techniques begin to run out of oil. At current levels of production, the GCC has a 50-year supply of oil averaging $700 billion of revenue at a conservative market price of $70/barrel.

World Hydrocarbon Reserves

As investors enjoy returns from the robust oil industry in the GCC, they will also witness the emergence of the region as a more diversified economic group. Half of the population in the GCC is under 20. Thanks to the wealth of government petrodollars, this population is generally well educated. This demographic situation gives these nations plenty of room for economic expansion across a more diverse variety of industries and sectors. A portion of the large young and educated workforce will quickly be absorbed into the hydrocarbon industry, leaving the rest to build up these alternative sectors.

Despite the region’s success and stability on account of its oil exports, equity markets remain undercapitalized. Although the GCC has more than a third of the world’s energy reserves under its soil, its total market capitalization is less than one trillion dollars. This approximately equal to the total market capitalization of a single western country. The region’s markets are relatively liquid compared to similarly undercapitalized frontier economies and generally comply with western standards of regulation and transparency. Add to this the fact that GCC equity markets have yet to return to 2005 pre-crisis levels and the advantages of investing in the Gulf Coast become apparent.

As with any investment, individuals interested in exploring the possibility of investing in the GCC region should consult with their financial advisor to discuss risks, options, potential returns, and whether such an investment is a good fit for that investor’s financial goals. AVC advisors are experts in emerging market investment and can help clients find appropriate funds with which to begin their investment in the Persian Gulf Coast.