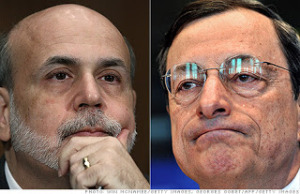

Recently, European Central Bank (ECB) President Mario Draghi endorsed an open-ended bond-buying program of troubled European sovereign debt. This decisive monetary move was solidified after German courts confirmed the country’s support of the ECB’s unusually active program. Businesses and investors in the Eurozone have welcomed the program, viewing it as a sign that the leaders of the bloc will support the debt ridden member states. Earlier in the summer investors and commentators feared both that Greece could leave the Euro and that burgeoning debt crises in Italy and Spain would exert too much political and economic pressure upon the currency zone for it to remain robust and intact.

Less than two weeks after the ECB announced its bond-buying program, the United States Federal Reserve announced a much anticipated third round of quantitative easing. The central bank plans to purchase $40bn of mortgage-backed securities a month until as late as mid-2015. While the policy has been the target of innumerable critics, Fed officials hope that monetary aid to the real estate market will reverberate throughout the economy, stimulating credit and economic output.

The immediate consequence of these two announcements is that the global investment environment is quite different than it was three weeks ago. Sovereign yield curves are falling and flattening, equity markets are up, and rating agency Egan-Jones downgraded the credit rating of the United States. Put/Call ratios fell sharply after the announcement and commodity values have increased. As time progresses and the initial scramble for position after the dual announcements relaxes, many analysts are expecting that real growth in equity markets will persist.

The long-term consequences of central bank monetary stimulus are harder to gauge. Critics of the ECB and Fed point out threat of inflation that comes from a third round of monetary stimulus in the US. It is not uncommon for critics to pair the inflationary pressure of this year’s drought and consequent reduced crop yields with credit expansion to project a burst of high inflation at some future point.

The hyperinflationists have been decrying every Fed and ECB move since 2007, predicting hyperinflation after QE1, QE2, and Operation Twist. While non-CPI categories of consumption such as food and fuel have indeed risen more than the official inflation figure, the data has failed to support any of the inflation hawks’ forebodings. Investors interested in both the rising price of gold and gold as a hedge against inflation should understand the macro economic situation in which such an investment would occur.

Gold has reliably risen in response to money supply expansion since the financial crisis began nearly five years ago. This should not be unexpected. There is a strong correlation between the price of gold and the size of the money supply for the most basic of economic reasons i.e. as more dollars chase the same amount of gold, the amount of dollars required to purchase a fixed amount of gold rises. Theoretically, this pattern should hold throughout the economy, with all goods rising proportionally in price to the increase in the money supply. In the long run, this seems to be empirically accurate. In the medium and short run, however, gold has risen faster than the CPI and has risen more closely proportional to bank credit expansion. Why is this?

The two major reasons are that the price of gold is pushed upward because of its status as a safe haven, inflation hedge, and store of value. In other words, investors alter their behavior in response to monetary policy in a way that consumers do not. Consumers do not respond to stimulus by purchasing more automobiles or groceries as an investment. The effect of stimulus may be that lower interest rates will drive consumers to purchase a new car. Car prices will rise because of this but the time frame for this rise will presumably take months or years while the rise in gold can take days or hours. With regards to food inflation, this comes about after monetary stimulus after credit has expanded throughout the economy through loans, raising quantity demand for food at previous prices and thus driving up food prices.

This temporal structure is what concerns the hyperinflationists. Such a catastrophe is possible but seems to be a very remote possibility. A few investors may be purchasing gold in anticipation of bedlam but apocalyptic fears are hardly a robust enough sentiment to motivate portfolio investment. This expectation, however inaccurate it may be, does raise a critic point about gold value after stimulus.

Gold Price: Aug. 21-Sep.24 (2012)

*QE3 announcement leaked Sep. 12

We understand how gold rises in response to an expansion of the money supply for purely economic reasons. We have also explained the rise of gold because of behavioral modifications that investors make in response to stimulus. These reasons are multifarious and can include, naming only two, fears of inflation and negative sentiment by investors prompted by further monetary action. A third key component of price level can generally be considered the speculative component. Anticipating the first two reasons for a rise in price, investors buy gold products deliberately in order to earn a return buying low and selling high.

With the implications for gold of the Fed and ECB’s further stimulus in mind, what should investors who are interested in or have already invested in gold do? Such an answer is obviously dependent upon one’s own financial goals. For investors who remain uncomfortable with the economic outlook of the Eurozone and United States, gold can serve as the timeless safe haven it has always been. For investors willing to take some risk, returns can be generated both from the vacillations in gold’s value and/or its potential long term sustained rise.

Return can be generated from long term rise in value and via price vacillation

To evaluate the risk and potential reward of gold investment in a time of monetary stimulus, an experienced financial advisor is indispensable. A variety of gold products are available and their efficacy varies by end sought. AVC Advisory team members can help investors fit their gold strategy within a portfolio that is sensitive to investors’ overall financial goals.