Recent financial news has been permeated with talk of a new round of quantitative easing. Quantitative easing is a monetary policy used by the U.S. Federal Reserve system’s Federal Open Market Committee (FOMC) where the Fed expands its balance sheet by purchasing securities (usually from the U.S. Treasury) on the open market. During the 2008 financial crisis, the Fed performed two rounds of quantitative easing, a policy that has received a mixed response from economists.

The proposed new round of monetary easing (QE3) comes on the heels of “Operation Twist,” a monetary tactic designed to flatten the U.S. Treasury yield curve. Proponents of QE3 argue that the current state of the economy is such that additional stimulus is required in order to stave off an autumn decline in output. A new round of securities purchases would be a defensive counter cyclical move by the Fed.

Recently, Boston Federal Reserve Bank President Eric Rosengren publically called for a sizeable QE3 in response to disappointing output projections for the remainder of 2012. Although President Rosengren is a non-voting member of the FOMC this year, his call for a third round of monetary stimulus is demonstrative of the pro-stimulus wind of the committee. His comments during a CNBC interview on Monday also included a call for lower interest rates on central bank deposits.

In a perfect world, quantitative easing would inject needed liquidity into the economy, lowing interest rates, and stimulating business investment. This increase in investment would then raise total economic output. Consequently, unemployment would fall, consumption would increase, and the economy would be put on the right track.

The actual results of QE1 and QE2 are ambiguous. As anybody who has been paying attention to the news over the last few years knows, unemployment is high, consumption is unstable, and developed world output has been nearly stagnant since 2007. Defenders of the Fed’s action claim that had there been no quantitative easing, the global recession would have been far worse. Opponents point to the threat of inflation and the erosion of short term lending due to nearly negative interest rates.

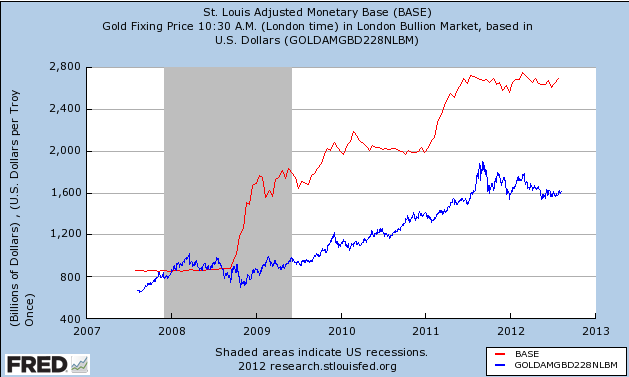

Regardless of the macroeconomic effects of past quantitative easing, the prospect of a QE3 raises a number of important points for investors. One of the most talked about implications of QE3 is its effect on precious metal prices. Precious metals appreciated in response to monetary stimulus during the first two rounds of quantitative easing. A Fed security purchase entails the virtual creation of new currency and the expansion of the money supply. This increased supply of money weakens the dollar and causes metals to appreciate. Precious metals thus can be considered a store of value. Investors are better off holding a real asset than paper currency during inflation.

Red: Monetary Base

Blue: Gold price per ounce

Gold and silver have been recognized as intrinsically valuable for millennia and investors know this. If QE3 seems likely, investors will buy gold ahead of time so that they can benefit from the appreciation. This second force (anticipatory purchases of gold) is the key to earning a return on a gold rally. Ideally, one would like to purchase gold at the lowest price possible before both the anticipatory purchases begin in earnest and the monetary expansion occurs. If the price of gold increases, it will be largely because of market, not monetary forces. Investors may want to discuss the prospect of investing in gold or silver with their financial advisor during what could be a new rally in precious metals.

Financial newspapers, talk shows, and blogs are all discussing QE3. There seems to be an incomprehensible volume of opinion and speculation, some good, some bad, over Fed policy and investor sentiment. An experienced financial advisor can help his or her client sift through the mass of opinion and determine what is the best course of action given the potential for a rally in metals. In addition to discussing strategy, risks, and potential returns, advisors can help clients better understand the variety of metals based products, including gold and silver ETFs, physical metals, bullion, certificates, and stocks.