Блог

Наши наблюдения, идеи и новости инвестиционного мира

Recently in Fortune, Warren Buffett devotes a few paragraphs to gold and the ‘fools’ worshipping it. He explains why gold is generally a lousy investment, even if its price in dollars goes up from time to time. If you molded all the gold in the world into a cube, Buffett claims, it would be about …

- 27.03.2013

- Категории: Аналитика

- Метки: обзор рынка, тенденции рынка

В видео-обзоре вы узнаете, как ситуация на Кипре сказывается на психологии инвесторов и почему в таких условиях активно инвестировать в российские фонды было бы опасно и необдуманно.

- 23.03.2013

- Категории: Аналитика, Основы инвестирования

- Метки: драгоценные металлы, платина

Platinum is much scarcer than either gold or silver. Consequently, its price tends to run significantly higher than these two metals during periods of economic stability. In periods of uncertainty, the price can fall below that of gold due to its relatively elastic demand. The main driver of its price is demand, as mine production …

We generally do not analyse individual stock for clients or agents. However, we were posed with an interesting idea from one of our agents regarding Ford (F). The stock currently trades with a P/E ratio of less than 10. The agent was wondering if this looked like a entry level for a buy on Ford. …

Cyprus: lovely island of sun, sea, sand which, you may have noticed, has been in the news for other reasons this week. As things stand, senior Cypriot government officials are in Moscow attempting to stave off an economic crisis which affects not only this small Eastern Mediterranean island, but Europe’s entire financial system. I don’t …

When I met with the inimitable Jeffrey Gundlach in Berlin last autumn, little did I know that the Barron’s crowned ‘king of bonds’ was about to do a 180 degree turn and focus on the equity markets by launching a troika of US funds. Of course, thinking back, the signs were there. He talked down …

Harvard Management Company, investment manager of the largest U.S. university endowment plan, has been one of the more active users of ETFs among university endowments. The investment firm uses ETFs to access emerging markets funds.In its recent statement of holdings, HMC owns about 20 ETFs — not surprising. It has, however, slashed its exposure to …

Если все ждут падения рынка, то хороший способ заработать в короткий срок — это купить ближайший фьючерс на VIX. (Индекс волатильности VIX отражает страх инвесторов по поводу динамики рыночных цен и помогает оценить панику либо излишний оптимизм фондового рынка). На случай падения рынков разумный потенциал индекса VIX выше 45, причем в короткие сроки. За всю …

- 19.02.2013

I recently caught up with Joep Huntjens, Head of Asian Credit at ING and lead manager on the ING Asian Hard Currency Bond Fund, for a review of how the fund has been performing and what the outlook was for 2013 and beyond. The fund has been hugely successful over the last year and had …

Continued Hard Currency Asian Bond Ecstasy for INGs’ Dutch Master? Читать далее »

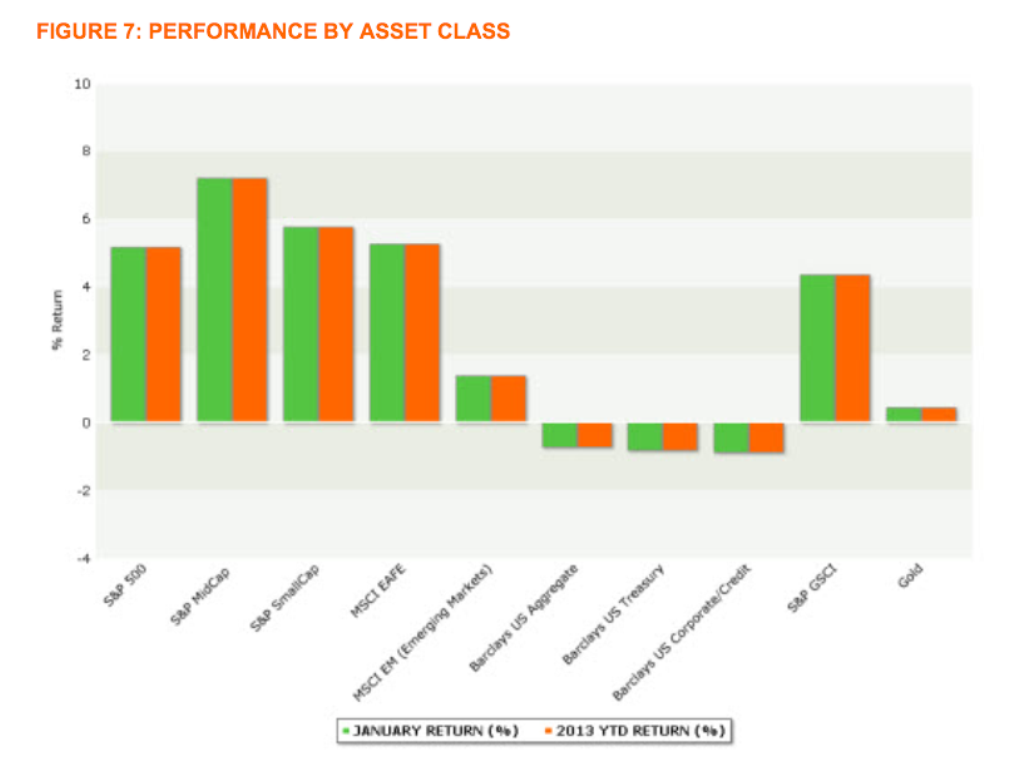

На графике отражены показатели доходности по различным инвестиционным активам за январь 2013. Лидерами стали американские компании средней капитализации с доходностью более 7% , а в проигрыше оказались все категории облигаций — в среднем -1%. Золото топталось на месте. Но медведи уже готовят наступление. Что у нас есть в арсенале? В предверии снижения цен на акции …