Goldman Sachs

Interestingly, the bank’s chief researchers are looking at the revolution in shale gas extraction as a potential boon to economic growth. Prior to the development of technology capable of releasing previously untapped fossil fuel, energy constraints had been a constraint upon economic growth. The cost reduction to production that an increased supply of energy heralds offers the possibility of “tailwind” to economic growth over the course of the next decade. In the words of head of commodities research, Jeff Currie, “at the very least, it removes the headwind.”

Goldman’s outlook on gold places the metal at the intersection of two opposing economic forces: central bank balance sheet expansion and improvement in the global economy. As noted multiple times on this blog, the price of gold is largely a function of perceived global risk and the supply of money. Although the Federal Reserve’s stimulus activity will not fully subside in 2013, Goldman Sachs anticipates that the relative effect of a stronger economy and the myriad alternative low-risk investments that such an economy offers will outweigh the expansion of central bank balance sheets. The bank is anticipating a peak gold price in March of $1825 an ounce followed by a gradual decline toward $1750 in 2014.

Credit Suisse

Despite its more cautious outlook, Credit Suisse expects 2013 to be a positive year for the global economy. According to Head of Investment Strategy and Asset Management, Anja Hochberg, the “worst is over for the economy.” The order of the day remains prudent diversification. In 2013, the bank will be focusing on corporate bonds while keeping a keen eye on emerging market bonds in the event that local currencies begin to appear more attractive. The bank holds that the biggest investment challenge of the new year will be the persistence of low interest rates.

As far as gold is concerned, the Credit Suisse outlook breaks from that of Goldman Sachs. Geopolitical risk, anticipation of inflation, bank balance sheet expansion, low interest rates, and a weaker dollar are all cited as reasons to expect the price of gold to continue to appreciate.

Morgan Stanley

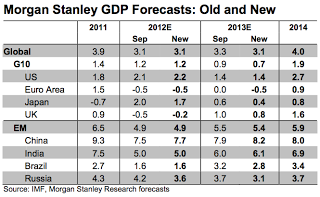

Morgan Stanley’s expectation of growth in 2013 is perhaps the most pessimistic of major investment banks. The bank expects global growth of 3.1% with a negative growth rate in Europe and sub-2% growth in the US, Japan, and UK. The only point of optimism comes from emerging markets, with the greatest output expected from China and India. Several of the bank’s economists have gone so far as to expect a mild recession in 2013.

Morgan Stanley’s equity markets research team has forecasted an S&P 500 price target of 1434; today’s index is 1426. The team’s leader, Adam Parker, emphasizes China exposure as the key strategy for 2013. This is consistent with bank’s expectation of further demand in China despite its relatively lower rate of output compared to previous years.

A glimmer of optimism appears in Morgan Stanley’s forecast for the US housing market. It expects a gradual increase in property values over the course of the next year. More than any other issue however, the bank’s 2013 outlook is contingent upon the result of the US fiscal cliff negotiations, now in the process of concluding.

UBS

The bank anticipates global growth of around 3%, with 2% growth in the United States due to active Fed policy in 2012 and expected improvements in the housing market. Its outlook for the Eurozone is mixed. The regional bloc will narrowly escape recession with a majority of growth coming from Germany and, somewhat surprisingly, Italy, as it moves beyond the peak of its austerity program. 2013 will likely be a rough year for Spain, especially for its banking sector. UBS expects that Spain will be forced to request support from the European Stability Mechanism early this year as bond yields rise due to unsustainable debt-to-GDP and loan-to-deposit ratios. Because of German hesitancy to support fiscal transfers to troubled Eurozone countries prior to September elections, a permanent solution to the seemingly endless European crisis will be further delayed. The probability of a Greek exit from the Eurozone in the next three years is estimated to be 50%.

In emerging markets, UBS expects 2013 to be a strong year for the BRIC countries. Investment strategists prefer corporate to sovereign debt in emerging markets and plan to diversify with emerging market currencies due to their solid appreciation potential. Inflation in emerging markets is expected to be relatively tame next year thanks to relaxed energy and food prices.

UBS’ general recommendation for 2013 is that investors seek yield in asset classes beyond government securities. Like Credit Suisse, emphasis has been placed upon corporate debt, especially in emerging markets. Diversification must be a hallmark of investment strategy in 2013 as the world economy continues to deleverage and grow sluggishly.

Looking Ahead

If anything can be gleaned from the variety of predictions presented by the experienced experts who have compiled the above reports, it is that the coming year will be marked by no less uncertainty than we have grown accustomed to in the post-2008 economy. While there may be more cause for optimism than in years past, investors should remain cautious and seek the advice of financial professionals before investing. General outlooks on the state of the world economy and areas where yield can be sought are no substitute for the personal attention to specific investment goals and strategies that AVC Advisory’s experienced financial consultants provide for their clients.