What is a Hedge Fund?

Hedge funds are made up of capital pooled by multiple investors for the purpose of investing in a variety of ways. They are generally not subject to extensive government regulation because they are private funds not sold to public or retail investors. Hedge fund managers are usually highly experienced, accredited financial professionals and employ a myriad of advanced investment strategies to generate return. These strategies include but are not limited to leverage, short selling, long and derivative positioning, futures, emerging markets and distressed firm investment.

Hedge funds receive aggressive personal attention from managers who usually have either a personal stake in the fund they manage or an otherwise strong financial incentive to generate high return. Hedge funds are typically oriented toward absolute rather than relative profitability, making it possible to receive revenues during times of both a rising and falling stock market.

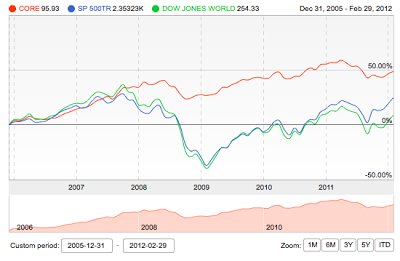

Red= Dow Jones Credit Suisse Hedge Fund Index

Who Can Invest in a Hedge Fund?

Legally, hedge funds are private investment partnerships limited to a specified number of investors capable of providing a relatively large initial investment. Investors are usually required to demonstrate a high personal net worth before they are allowed to invest in a hedge fund. Investment is relatively illiquid and open ended. Typically, terms are structured such that investors may withdraw their money at previously specified, regular intervals. Today, traditionally conservative pension funds and other institutional investors such as university endowments are investing in hedge funds.

How is a Hedge Fund Different than a Mutual Fund?

Mutual funds, like hedge funds, are made up of a pool of funds from multiple investors. Money market managers manage these funds and focus on stocks, corporate bonds, sovereign debt, and money market instruments. Such a strategy is more traditional than the strategies employed by hedge fund managers. Mutual funds allow small investors to participate in gains from investment in a diverse portfolio of stocks and bonds without having to single handedly raise the large amount of capital required to build a diverse personal investment portfolio.

Hedge funds are more exclusive than these publically available mutual funds and, as noted earlier, require much more initial investment than mutual funds require. Also, hedge funds are oriented toward a more aggressive strategy. Mutual funds do not, and are prohibited by regulation in many cases, from employing the alternative tactics that hedge funds are able to profit from.

How do hedge funds manage risk? How risky is investing in a hedge fund?

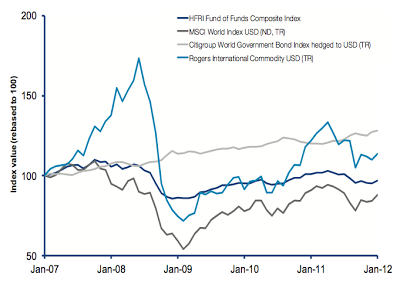

The term “hedge” implies the hedging of risk. Hedge funds generally seek to reduce risk and produce adjusted return usually uncorrelated with movement in market indices. For example, between 1993 and 2010, hedge funds were 1/3 less volatile than the S&P 500 stock index. Fund managers are some of the most experienced financial professionals in the world and have extensive experience with risk management. While investment in a hedge fund may be relatively illiquid, fund managers tend to keep their fund’s investments liquid. Risk is also checked by operational due diligence on the part of investors and their personal financial advisors. Some hedge funds are riskier than others and investors must evaluate what kind of hedge fund they wish to invest in before risking their money.

How are hedge funds Currently Performing?

Generally, hedge fund performance can be difficult for the public to obtain. However, several hedge fund indices are available and some individual hedge funds are listed (but not traded) on international stock exchanges. Others report performance summaries to industry journals or consulting firms.

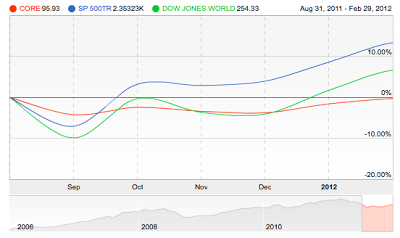

Last year was a difficult year for hedge funds, especially in the fourth quarter. Data on 2012 returns collected so far suggests hedge fund returns are on the way back to positive. Risk relative return, formally referred to as “alpha,” was generally positive in the first two months of 2012 for most types of hedge funds. Improved global outlook and rallies in equity and credit markets have supported this positive hedge fund performance. Many analysts are expecting this positive trend to continue. These analysts point to a greater risk appetite in 2012 and strong emerging market hedge fund performance as indicators of a relatively prosperous 2012 for hedge fund investors.

Red= Dow Jones Credit Suisse Hedge Fund Index Aug 2011- Feb 2012

Dark Blue= HFRI Hedge Fund Index; note stability relative to bonds and equity markets

Why should a hedge fund be a part of my portfolio?

Hedge funds offer the opportunity to engage in investment strategies that require both a large amount of risk exposed capital and careful attention. By becoming a hedge fund partner, investors can gain from both pooled risk and full time monitoring of their investment. Additionally, hedge funds can provide a private portfolio with returns regardless of fluctuations in market performance. Adding hedge funds to a portfolio is one more way to diversify a personal portfolio and hedge risk across a variety of investment categories.

How can I start investing in a hedge fund?

Interested investors should, as always, consult with a personal financial advisor before embarking upon any investment. An advisor will help his or her client find a hedge fund that aligns with the client’s personal financial goals and then assist the client in making an initial investment. Once a client is an investor in a hedge fund, advisors will continue to work with the client to monitor hedge fund performance and provide operational due diligence.