The uncertainty and volatility of the Euro zone has many investors skeptical of the potential for returns from investment in Europe. Uncertainty about the future of the Euro has been at the forefront of investors’ concerns. While fear about the potential for a Greek sovereign default may be exaggerated, such fear is not irrational. The crisis in Europe has been painfully long and does not appear to be ending anytime in the near future. Politics is almost inherently uncertain and the Euro zone’s current economic problems require political solutions both within member states and at the international level.

All this uncertainty has led to a relative dearth of capital for financially distressed European companies. These firms are touched by the macroeconomic precariousness of the European crisis but are operationally independent from the states in which they exist. While investors may be rightfully dissuaded from investment in sovereign debt, they should think twice before lumping all European firms in with European governments when making investment decisions.

As in all cases, investment decisions should be made based on firm level fundamentals rather than misleading macroeconomic aggregates. Accordingly, investors in any economy can reap returns from investment. One strategy is to invest in the recovery of sound, undercapitalized and undervalued European firms. Such an investment strategy should focus on financial restructurings across several sectors in multiple countries. The aim is to keep investments relatively liquid, thus making it easier to exit individual investments. An appropriate time horizon for returns from European distressed fund investment is 6 to 18 months.

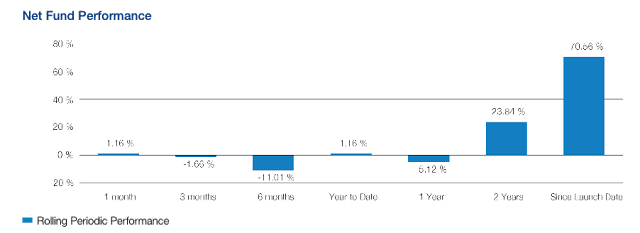

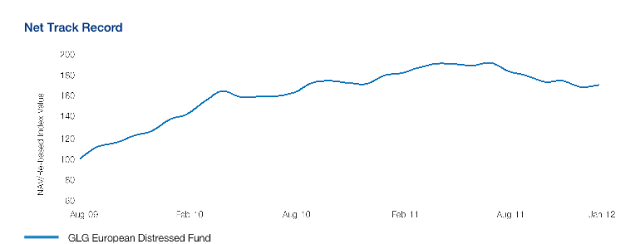

Since the Euro crisis began in earnest in 2009, funds following this strategy have enjoyed a return of nearly 70%. The success of any investment fund can be attributed to careful management guided by a sound strategy. As firms fail during economic recession, investment opportunities become available in the firms that are able to weather the crisis. In 2012, the business cycle recession has given way to a period of sluggish growth and relative uncertainty. The original, mid-crisis strategy is still applicable to the current climate as uncertainty about the Euro zone distorts prices and heightens volatility.

This allows investors to exploit two major opportunities. The first is the opportunity to purchase stock in companies at a discount relative to final recovery values. The second is the opportunity to engage in selective short crediting where market values misprice risk. Experienced fund managers analyze risk and return based on firm fundamentals. This bottom up approach employed by all of the fund’s numerous specialized team members has contributed to its high return.

Past success, of course, does not promise high returns in the future. While the fund takes precautions to minimize risk exposure, such as maintaining a high degree of liquidity and diversified leverage, investing in distressed firms in distressed countries entails risk. Investors interested in investing in distressed European firms should consult with an experienced financial advisor about how such a strategy aligns with their personal investment plan.